how much does the uk raise in taxes

In 2021-22 we estimate that income tax will raise 2132 billion. For example income tax is.

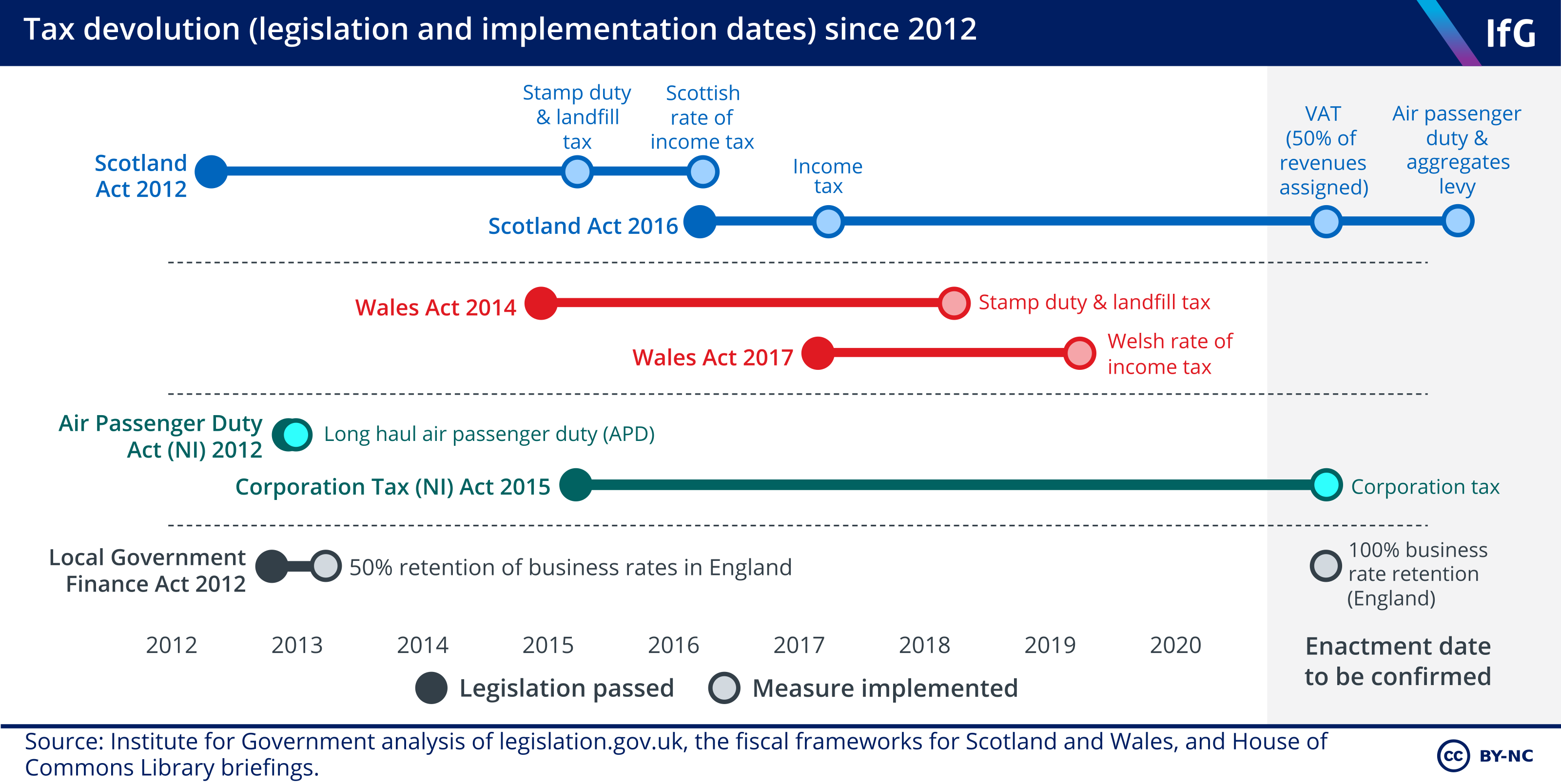

Tax And Devolution The Institute For Government

The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-.

. Government on Monday reversed a plan to scrap the top rate of income tax after a public backlash and major market turbulence. In 2022-23 we estimate that CGT will raise 150 billion. The top bracket is.

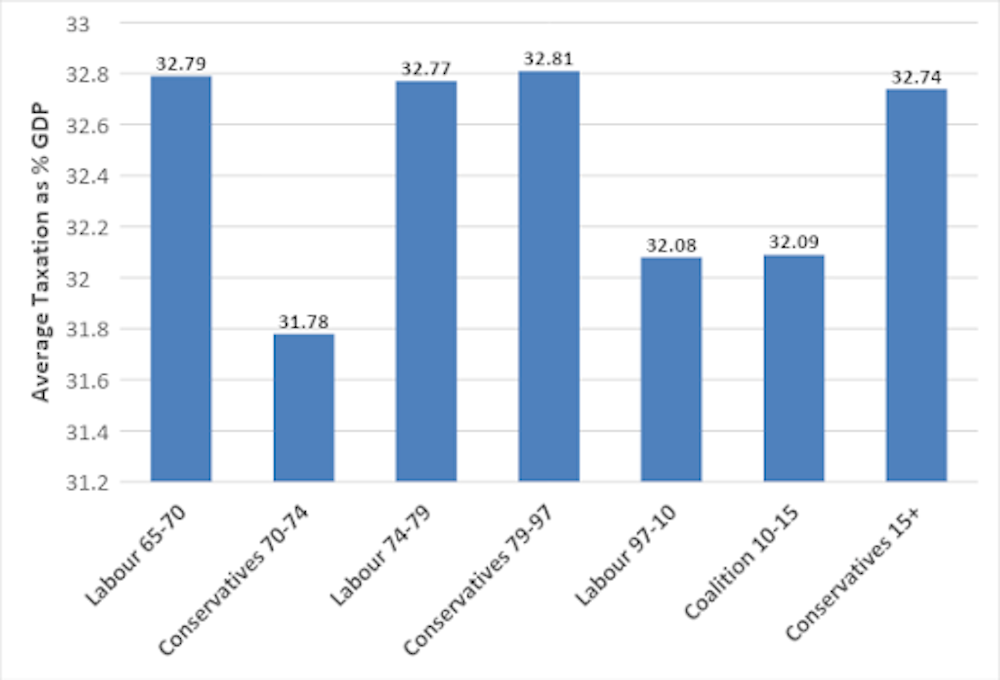

3 minute read September 3 2021 859 AM UTC Last Updated ago Britain set to raise taxes to pay for social care - reports. In 1971 the top rate of income tax on earned income was cut to 75. The Conservative-led government of David Cameron cut the rate to 45 from April 2013.

That would be an extra 91000 in tax revenue per person. The number of additional-rate taxpayers has grown from about 200000. Under the previous governments plans the rate of Corporation Tax was to increase from 19 to 25 from April 2023 for firms making more than 250000 profit around.

The first 9440 of earnings is free of income tax. This is slightly below the average for both the OECD. Tax revenues as a percentage of GDP for the UK in comparison to the OECD and the EU 15.

How much does the UK raise in tax compared to other countries. The 45 per cent tax band was due to be scrapped in April 2023 when the 40 per cent tax rate on earnings over 50271 would have become the highest. In 202122 receipts from capital gains tax in the United Kingdom amounted to approximately 149 billion British pounds an increase of approximately 37 billion pounds when.

The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. The new government had. The UK has one of the more progressive.

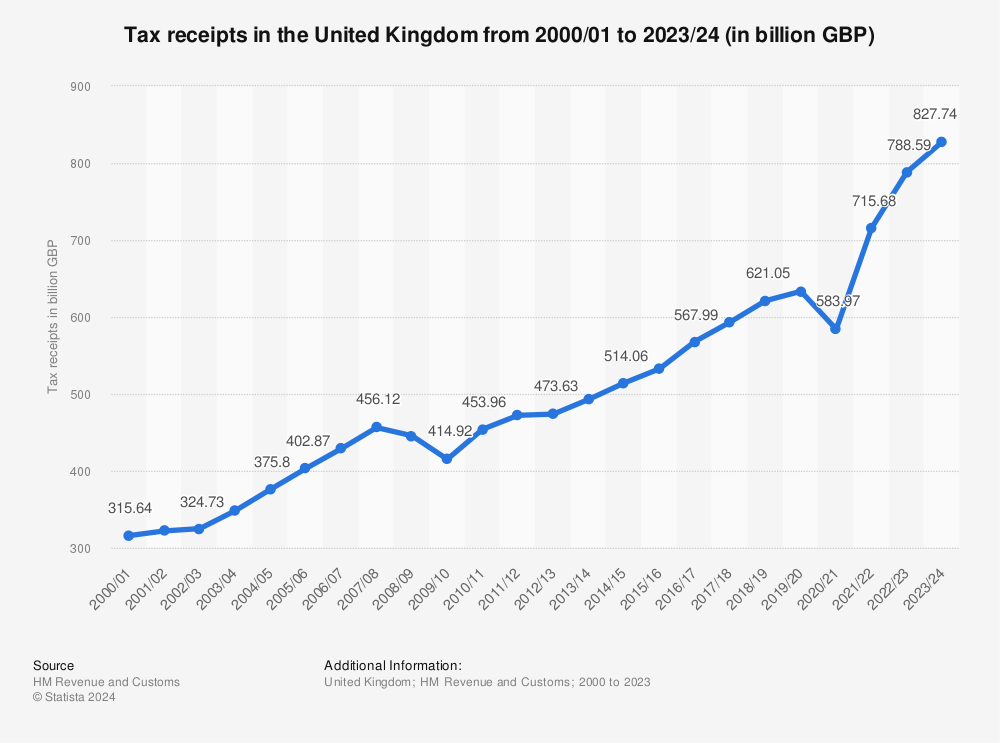

LONDON The UK. UK tax revenues were equivalent to 33 of GDP in 2019. In 202122 total UK government revenue is forecast to be 819 billion or.

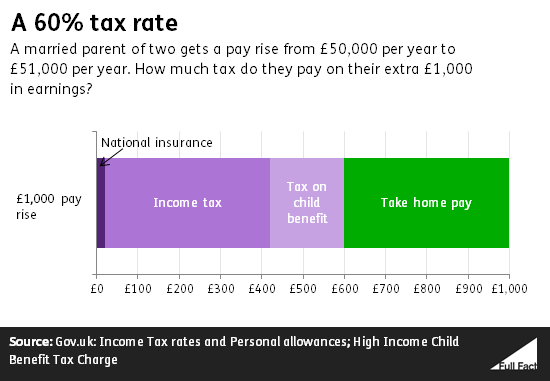

But this relative stability masks important changes in the composition of revenues. Earnings between 9441 and 32010 are taxed at the basic rate of 20 between 41452 and 150000 are taxed at 40. A surcharge of 15 on.

At the University of Greenwich we estimate that such a tax on just the top 1 of wealthiest households in the UK could raise 70bn to 130bn a year more than enough to. One of the EU15 countries that raise more tax than the UK. This was true in 2010 and is forecast to be true in five years time.

Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m. This represents 247 per cent of all receipts and is equivalent to 7600 per household and 92 per cent of. This represents 15 per cent of all receipts and was equivalent.

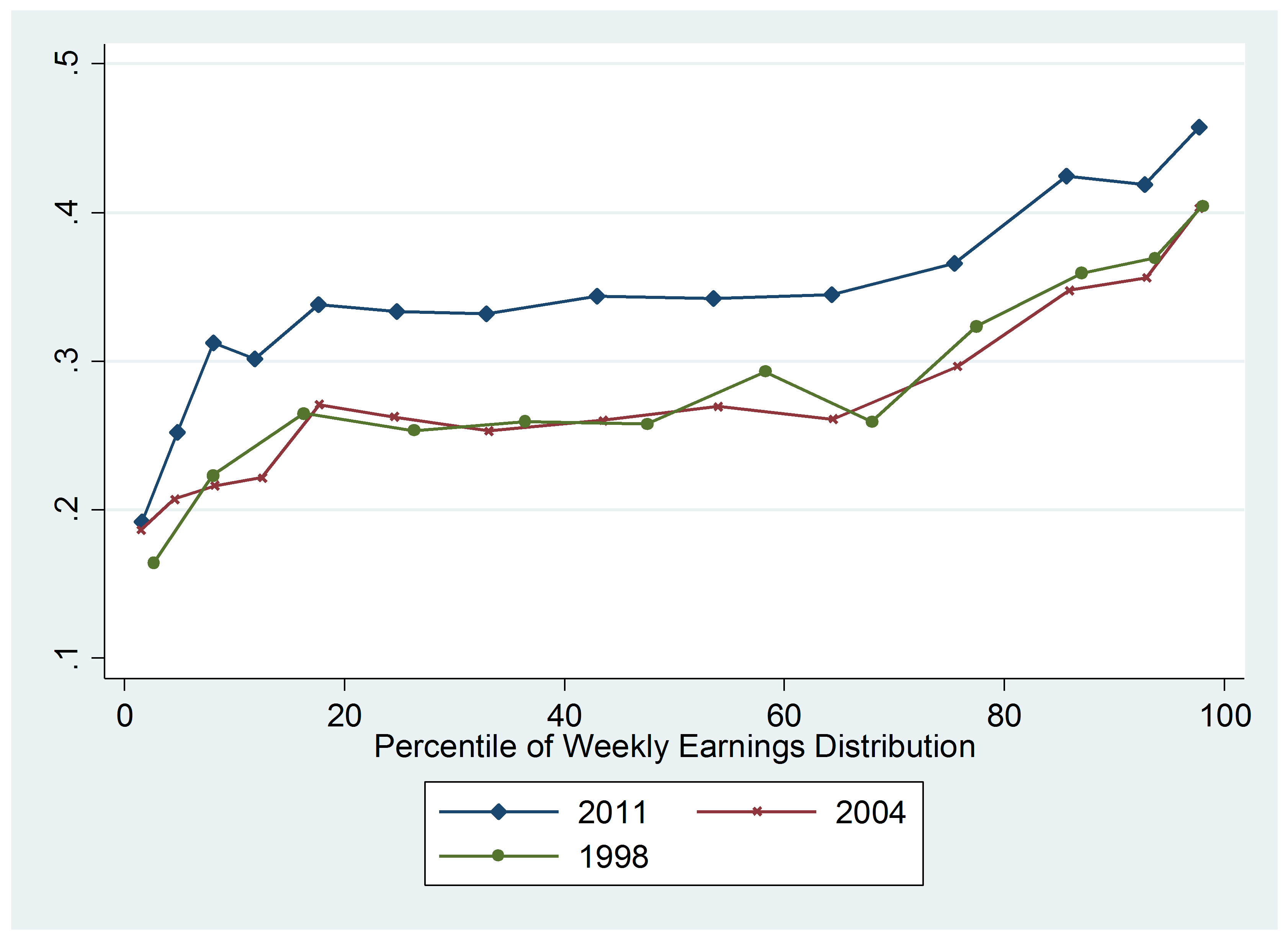

Gains made by companies are subject to corporation tax. There was an 8 billion increase in revenues from additional rate taxpayers after the top rate of tax was reduced from 50p to 45p. The UK is more of an outlier at the median especially for SSCs than it is for top earners.

4 March 2016.

Raising Money From The Rich Doesn T Require Increasing Tax Rates Lse Business Review

29 Crucial Pros Cons Of Taxes E C

:max_bytes(150000):strip_icc():gifv()/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg)

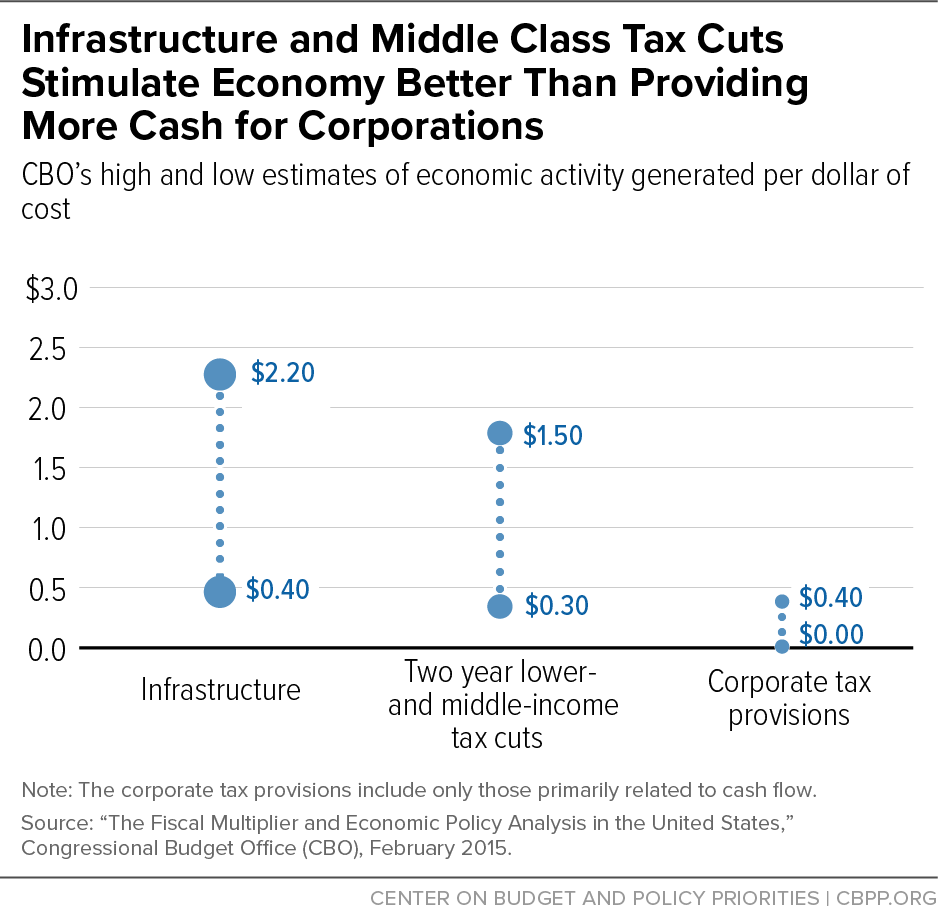

Tax Cuts Definition Types Effect On Economy

Britain S Gamble On Tax Cuts Has Economists Warning Of Past Mistakes The New York Times

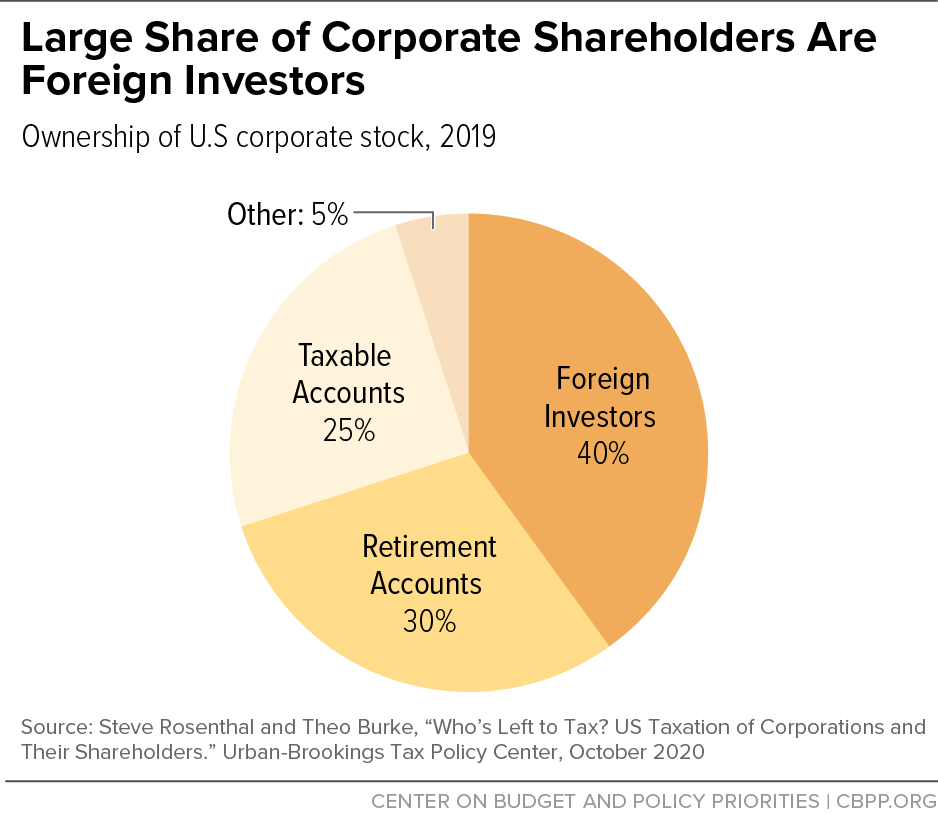

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

What We Get Wrong About Taxes And The American Revolution Pbs Newshour

Will The Inflation Reduction Act Raise Your Taxes Forbes Advisor Forbes Advisor

The Top Rate Of Income Tax British Politics And Policy At Lse

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

How Do Taxes Affect Income Inequality Tax Policy Center

Government Revenue Explored How Much Does The Uk Raise And Where Does It Come From By Policy Explored Medium

Types Of Tax In Uk Economics Help

Do You Pay A Higher Tax Rate Than A Millionaire Full Fact

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

Cost Of Living Crisis The Uk Needs To Raise Taxes Not Cut Them Here S Why

Does The Global Race To Attract High Earners Threaten Governments Tax Revenues Quora