Stage 3 tax cuts

The stage 3 tax cuts will give occupations like CEOs of large corporations surgeons and federal politicians a 9075 a year tax cut. 8 hours agoA politician on 211250 will get a tax cut of 9075.

Follow The Core Four Unshakeable Tony Robbins Unshakeable Your Financial Freedom Playbook Unshakeable Your Guide Investing Books Investing Personal Finance

Both sides have committed to sizeable personal income tax cuts in 2024-25.

. Australia does not need stage three tax cuts Tasmanian Senator Jacqui Lambie says Australia does not need stage three tax cuts as the Albanese government face growing calls from the Greens and unions to scrap stage three tax. For instance a. The changes were part of a three-stage tax reform package which was legislated in 2019.

The Stage Three tax cuts will add to inflationary pressures and permanently flatten the rate structure while leaving the problem of bracket creep unsolved. Labor after a bruising internal debate this. While aged care workers hairdressers and café workers will get nothing.

Stage 3 of the income tax cuts will cost 157 billion in its first year. Changes to marginal tax rates. 12 hours agoSpoiler alert.

When the LMITO ends teachers nurses and chefs will pay 1080 more in tax. The stage three tax cuts now supported by the Coalition and Labor will cost 184 billion by 2031-32Gabriele Charotte. The stage three tax cuts would abolish the 37 per cent tax bracket while the 325 per cent rate would be cut to 30 per cent for all incomes between 45000 and 200000.

Stage 3 tax cuts. The tax cuts introduced in Stage 2 are part of a 3 Stage tax cut program by the Federal Government to reduce the income tax rate for Australians. The stage 3 tax cuts worth 157 billion per year will come.

Costings by the budget office last year put the cost of the stage three tax cuts at 1842 billion over their first eight years of operation. The changes scrap the 37 per cent tax bracket for those earning above 120000. A politician on a.

Labor will retain the Morrison governments stage three tax cuts which predominately benefit high income earners and dump proposed changes to negative gearing that were taken to the 2016 and. The Stage 3 tax cuts will reduce tax revenues by more than 15 billion a year. Current details of the governments three-stage Personal Income Tax Plan including changes to personal income tax thresholds and rates of tax that apply to them are summarised below.

These were calibrated and legislated in. The richest 1 per cent of Australians and men in particular will get as much benefit from the stage three tax cuts as the poorest 65. These are the four economic wildcards to be unleashed between.

Now that the Low and Middle Income Tax Offset has ended the government should replace the Stage Three cut with a calibrated increase in tax thresholds to benefit the middle. The cuts are legislated to come into effect in 2024 and mean everyone earning between 45000. Creating one huge tax bracket from 45k to 200k and lowering base rate from 325 to 30 is an absurdly.

From 1 July 2020. Raising the lower threshold for the 37 tax bracket from 87000 to 90000. The stage 3 tax cuts will see everyone earning between 45000 and 200000 paying 30 per cent in tax from 2024.

The debate over the stage three tax cuts is ignoring the bigger tax issues facing the country. The package itself has been pulled and prodded ever since. Yep the stage three cuts are a boondoggle no doubt about it.

By way of comparison thats almost as much as the 163 billion will be spent on the Pharmaceutical Benefits Scheme. 12 hours agoThose earning 50000 a year could expect to save 240 in tax a week under the Stage 3 cuts but those earning 200000 per annum would save around 174 a week. These cuts will continue into future tax years until Stage 3 cuts are put into place in July 2024.

1 day agoPrime Minister Anthony Albanese said the government had not changed its position on stage 3 tax cuts. Stage 3 of the income tax cuts will cost 157 billion in its first year. The stage-3 tax cuts will only serve to further entrench wealth inequality This so called reform will make the income tax system less.

A registered nurse on 72235 will get a tax cut of 681. 21 hours agoThe richest 1 of Australians will get as much benefit from the stage-three tax cuts as the poorest 65 combined new parliamentary budget office analysis has projected heaping more pressure on. From 1 July 2018.

Who Gets The 250 Payment And Who S Eligible For The 420 Tax Offset In The Budget Abc News

Drive Without Borders One Nation One Road Tax Stay Order From Karnataka Hc Against Karnataka Motor Vehicles Taxation Amendment Act 201 Road Tax Tax Borders

Timeline The Tumultuous 155 Year History Of Oil Prices Crude Oil World Oil History

Silverado Rsr Silverado Personalized Items Performance

Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute

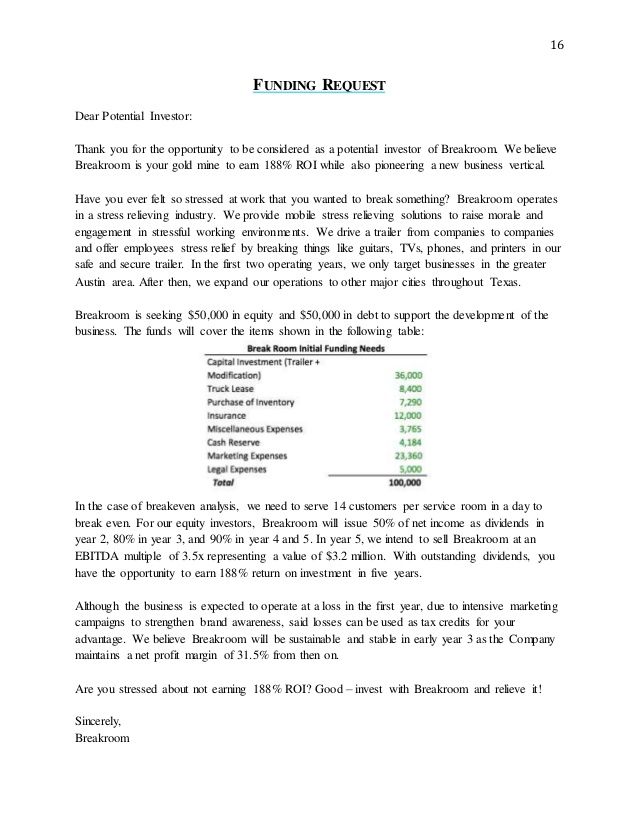

16 Funding Request Dear Potential Investor Thank You For The Opportunity To Be Considered As A Potential Investor Break Room How To Plan Business Planning

Medicare Vs Medicaid They Sound Similar How Are They Different Medicaid Medicare Medical Insurance

Alan Kohler Big Government Is Already Here But How Will We Fund It

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Green Design Home Upgrades Eco Friendly House Home Improvement Loans

Different Ways Of Valuing Your Startup Start Up Start Up Business Finance

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute

Financial Planning Tips For Beginners

Working Capital And Negative Working Capital Formula Is Defined With Examples It Measures The Differences Between What What Is Work Potential Growth Capitals

Gst Day Goods And Services Tax Day Indirect Tax

Should You Sell Or Rent Your Home Before A Military Move Military Move Buying First Home Moving